Pension Data for Sterling Properties Include the Following

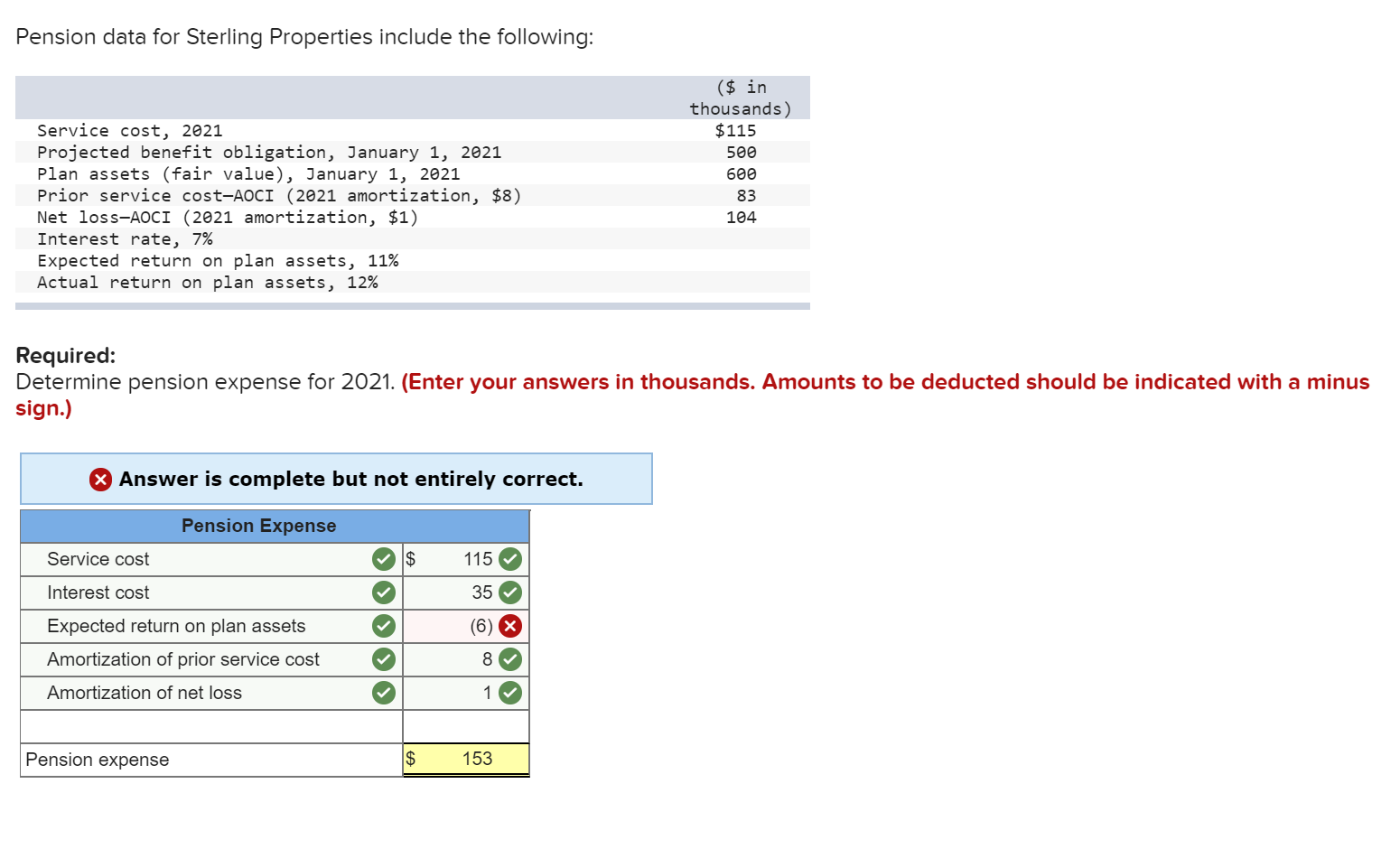

Pension data for Sterling Properties include the following. Service cost 2016 125 Projected benefit obligation January 1 2016 660 Plan assets fair value January 1 2016 700 Pension data for Sterling Properties include the following in 000s.

Solved Pension Data For Sterling Properties Include The Chegg Com

In 000s Service cost 2013 112 Projected benefit obligation January 1 2013 850 Plan assets fair value January 1 2013 900 Prior service cost-AOCI 2013 amortization 8 80 Net loss-AOCI 2013 amortization 1 101 Interest rate 6 Expected return on plan assets 10.

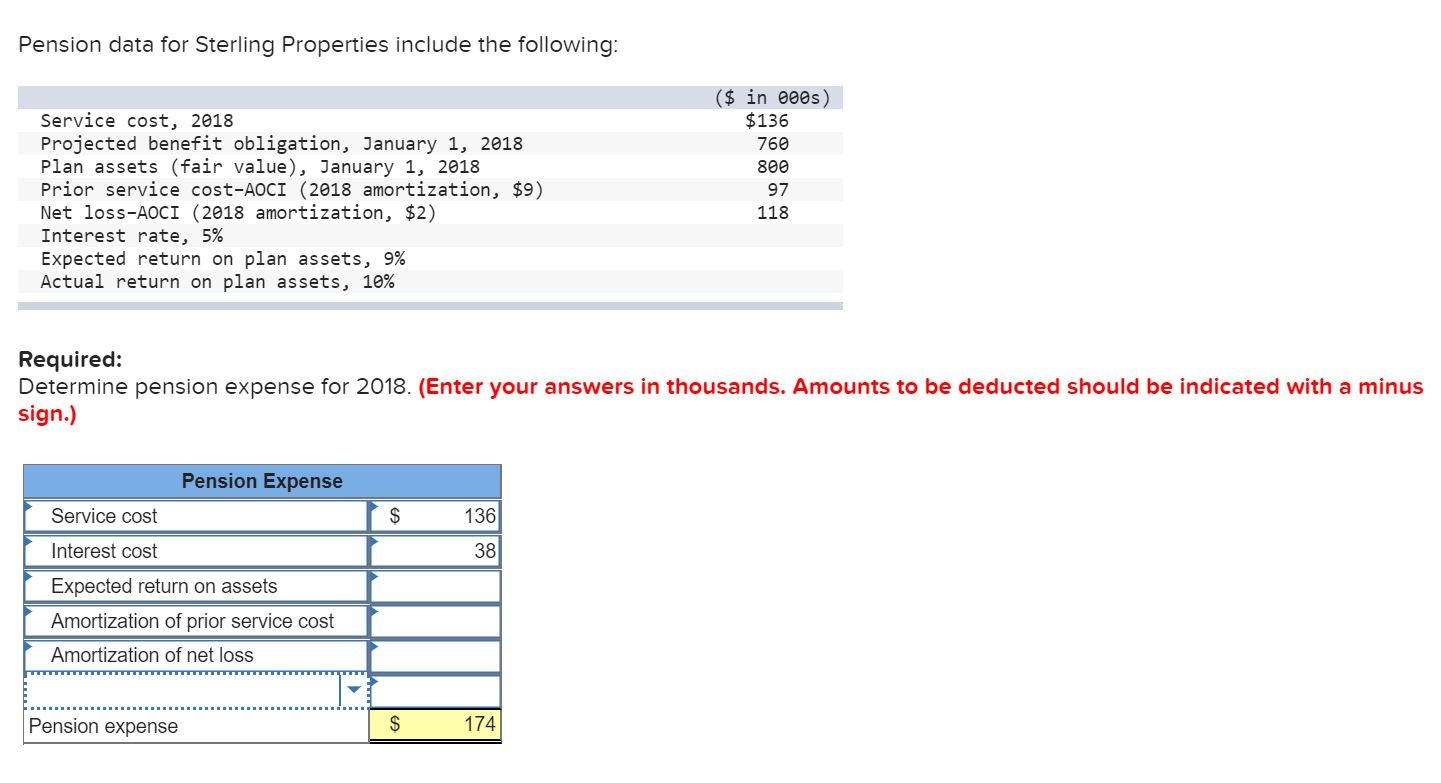

. Answer of Pension data for Sterling Properties include the following. Determine pension expense for 2018. In 000sService cost 2016112Projected benefit obligation January 1 2016850Plan assets fair value January 1 2016900Prior service cost-AOCI 2016 amortization 880Net loss-AOCI 2016 amortization 1101Interest rate 6 Expected return on plan.

Amounts to be deducted should be indicated with a minus sign Interest cost 6 x 850 51 Expected return on the plan assets 99 actual less 9 gain 90 11 900 - 10 900. Solutions for Chapter 17 Problem 8E. Pension data for Sterling Properties include the following.

Pension data for Sterling Properties include the following. Pension data for Sterling Properties include the following. S in 000s Service cost 2016 Projected benefit obligation January 1 2016 Plan assets fair value January 1 2016 Prior service cost-AOCI 2016 amortization 8 Net loss-AOCI 2016 amortization 1 112 850 900 80 101 Interest rate 6 Expected return on plan assets 10 Actual return on plan assets 11 Required.

In millions Discount rate 9 Expected return on plan assets 12 Actual return on plan assets 13 Projected benefit obligation January 1 620 Plan assets fair value January 1 600 Plan assets fair value December 31 630 Benefit payments to retirees December 31 84 Required. Pension data for Fahy Transportation Inc. In thousandsService cost 2021 112Projected benefit obligation January 1 2021 850Plan assets fair value January 1 2021 900Prior service costAOCI 2021 amortization 8 80Net lossAOCI 2021 amortization 1 101Interest rate 6Expected return on plan assets 10Actual return on plan assets 11.

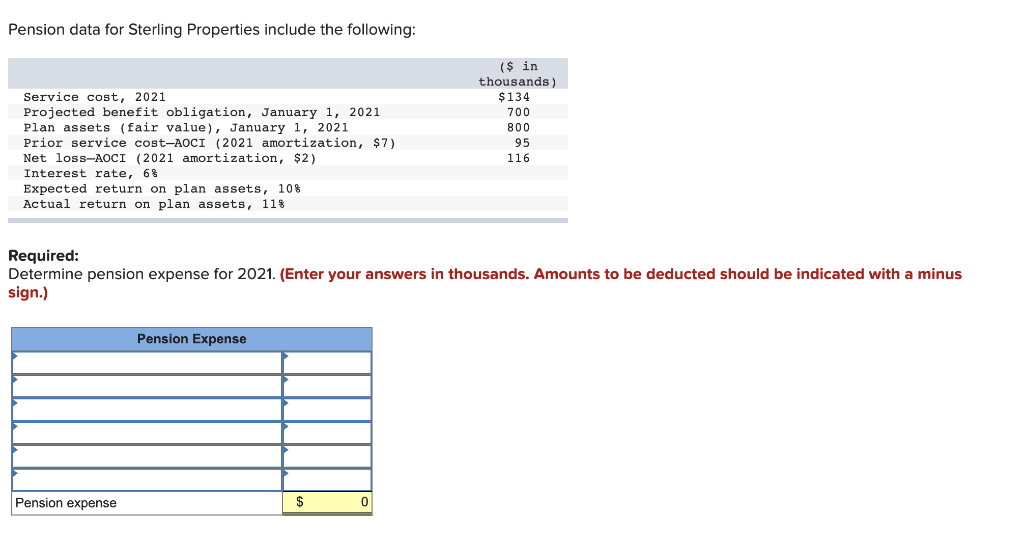

In 000s Service cost 2018 116 Projected benefit obligation January 1 2018 550 Plan assets fair value January 1 2018 600 86 107 Interest rate 6 Expected return on plan assets 10 Actual return on plan assets 11 Required. Pension data for Sterling Properties include the following. In 000s Service cost 2018 114 Projected benefit obligation January 1 2018 600 Plan assets fair value January 1 2018 700 Prior service costAOCI 2018 amortization 8 82 Net lossAOCI 2018 amortization 1 103 Interest rate 9 Expected return on plan assets 13.

In thousands Service cost 2021112 Projected benefit obligation January 1 2021 850 Plan assets fair value January 1 2021 900 Prior service costAOCI 2021 amortization 8 80 Net lossAOCI 2021 amortization 1 101 Interest rate 6 Expected return on plan assets 10. Pension data for Sterling Properties include the following. Pension data for Sterling Properties include the following.

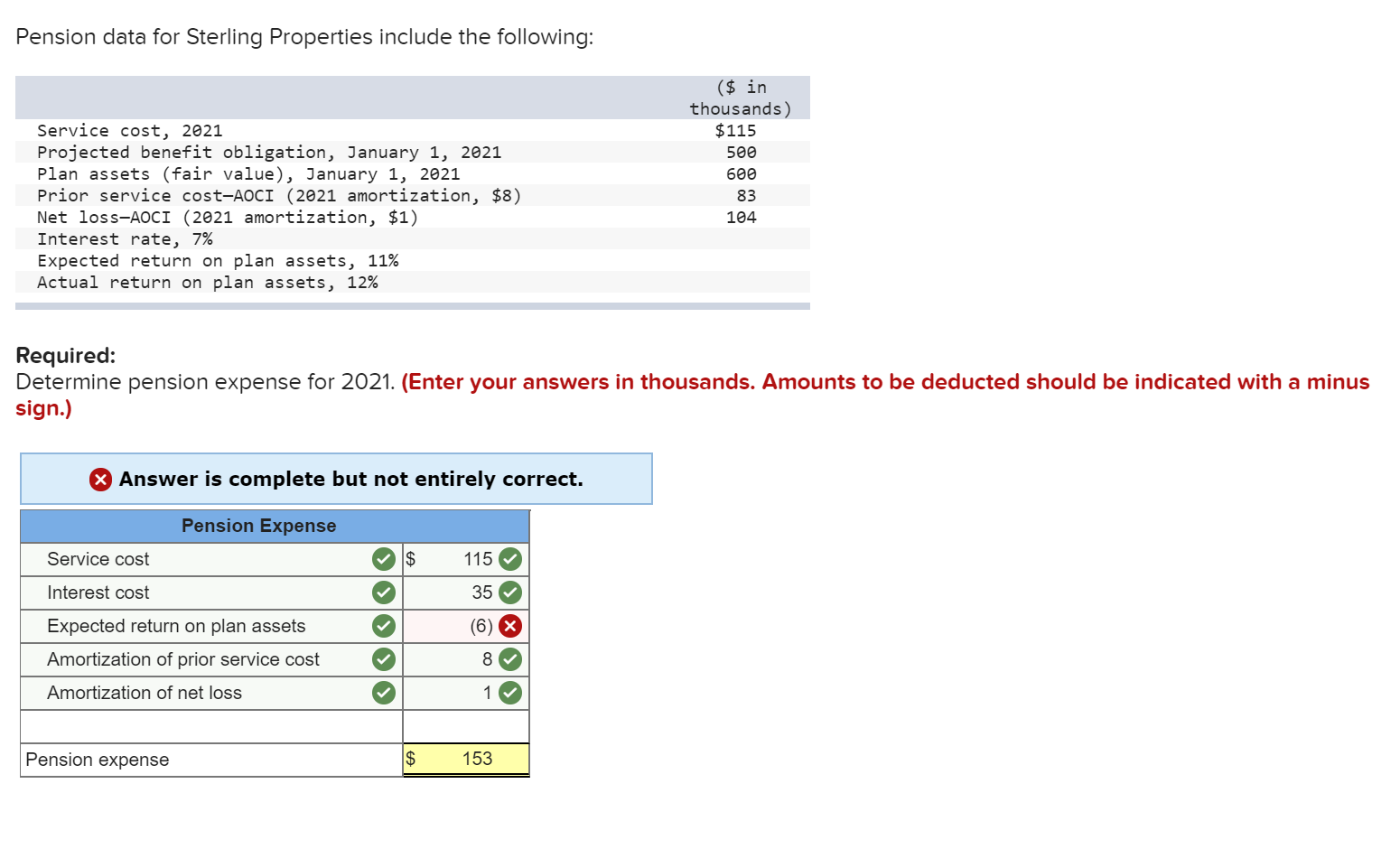

In thousands Service cost 2021126 Projected benefit obligation January 1 2021 850 Plan assets fair value January 1 2021 900 Prior service costAOCI 2021 amortization 7 91 Net lossAOCI 2021 amortization 2 112 Interest rate 6 Expected return on plan assets 10. Pension data for Sterling Properties include the following. In 000s Service cost 2018 112 Projected benefit obligation January 1 2018 850 Plan assets fair value January 1 2018 900 Prior service cost-AOCI 2018 amortization 8 80 Net loss-AOCI 2018 amortization 1 101 Interest rate 6 Expected return on plan assets 10.

Pension data for Sterling Properties include the following in 000s. In thousands Service cost 2021 112 Projected benefit obligation January 1 2021 850 Plan assets fair value January 1 2021 900 Prior service costAOCI 2021 amortization 8 80 Net lossAOCI 2021 amortization 1 101 Interest rate 6 Expected return on plan assets 10 Actual return on. In thousands Service cost 2021116 Projected benefit obligation January 1 2021 550 Plan assets fair value January 1 2021 600 Prior service costAOCI 2021 amortization 7 86 Net lossAOCI 2021 amortization 2 107 Interest rate 6 Expected return on plan assets.

Service cost 2011. In thousands Service cost 2018112 Projected benefit obligation January 1 2018850 Plan assets fair value. Enter your answers in thousands.

Pension data for Sterling Properties include the following. Pension data for Sterling Properties include the following. RequiredAssuming no change in actuarial assumptions and estimates determine the service cost component of pension expense for the year ended.

Pension data for Millington Enterprises include the following. Determine pension expense for 2018. In 000s Service cost 2018 112 Projected benefit obligation January 1 2018 850 Plan assets fair value January 1 2018 900 Prior service costAOCI 2018 amortization 8 80 Net lossAOCI 2018 amortization 1 1 101 Interest rate 6 6 Expected return on plan assets 10 10 Actual return on plan assets 11.

In thousands Service cost 2021. 8 rows Pension data for Sterling Properties include the following. BusinessAccountingQA LibraryPension data for Sterling Properties include the following.

Pension data for Sterling Properties include the following. Pension data for Sterling Properties include the following. Pension data for Sterling Properties include the following.

Pension data for Sterling Properties include the following. Projected benefit obligation January 1 2011. Determine pension expense for 2021.

Pension data for Sterling Properties include the following. RequiredAssuming no change in Pension data for Millington Enterprises include the following.

Solved Pension Data For Sterling Properties Include The Chegg Com

Solved Pension Data For Sterling Properties Include The Chegg Com

Solved Pension Data For Sterling Properties Include The Chegg Com

Comments

Post a Comment